Why You Should Purchase Silver Bullion: An In-Depth Guide

Silver has been recognized for its intrinsic value and unique properties for centuries. When you purchase silver bullion, you're not just acquiring a metal; you're investing in a time-honored asset that can help diversify your financial portfolio and provide a hedge against inflation. In this article, we will explore the numerous benefits, considerations, and strategies associated with investing in silver bullion.

The Value of Silver Bullion

Silver bullion refers to precious metal that is at least 99.9% pure. Unlike other forms of silver, such as jewelry or artistic items, bullion is typically sold in forms like bars, coins, or ingots, making it a straightforward investment vehicle.

1. Historical Significance of Silver

Throughout history, silver has been used as a form of currency and a storable wealth asset. From ancient Roman coinage to modern-day investment pieces, silver holds a significant position in the economies of many cultures. Today, investing in silver bullion is a way to participate in this long-standing tradition of wealth preservation.

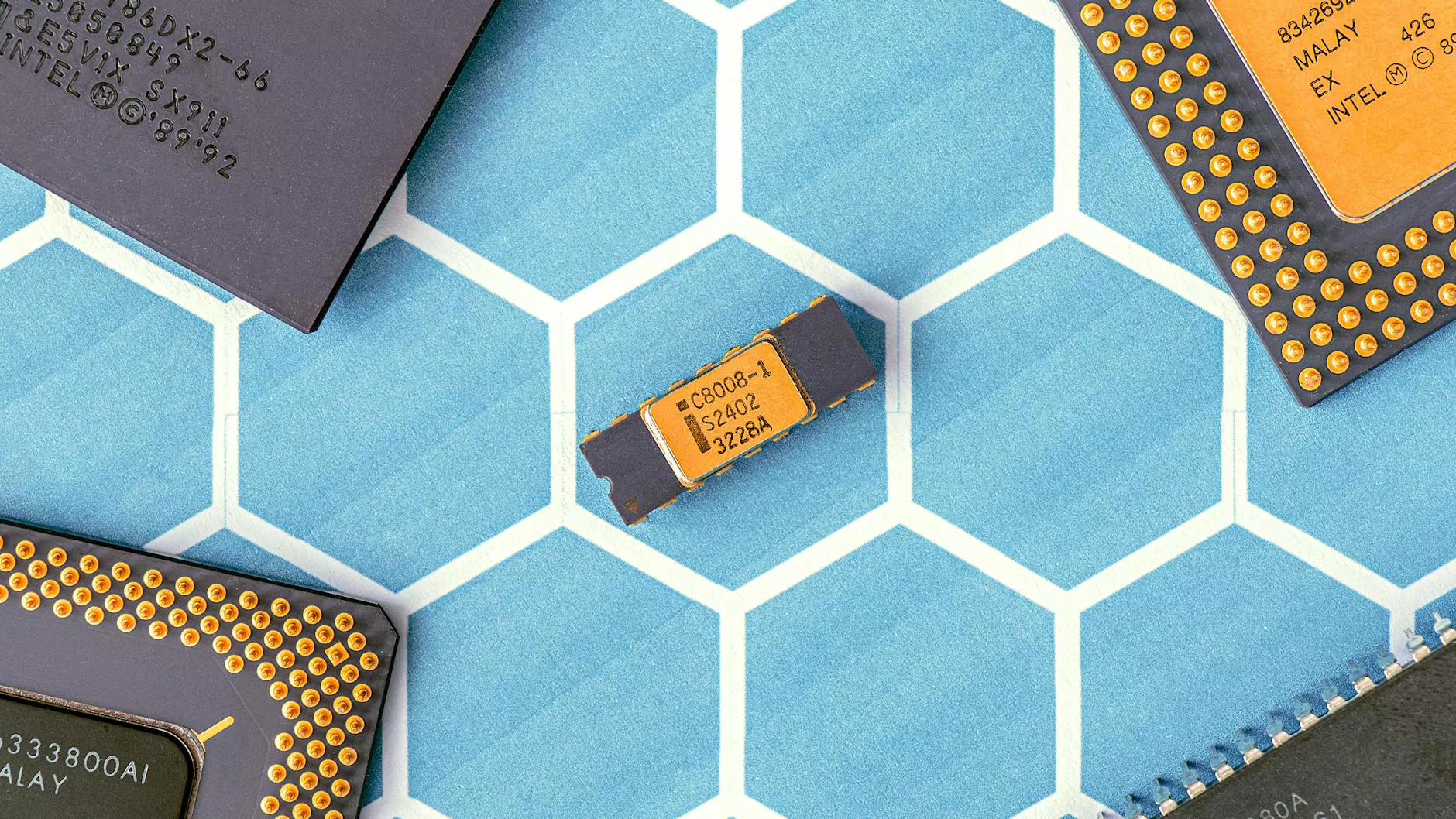

2. Silver's Unique Properties

Silver boasts several characteristics that make it an appealing investment:

- Conductivity: Silver is the best conductor of electricity, and it is used extensively in electronics, solar panels, and batteries.

- Industrial Demand: With its wide range of applications—from medical devices to photography—silver has sustained industrial demand that supports its price.

- Scarcity: Unlike gold, which has more significant reserves, silver is considered more scarce in terms of available refined bullion.

Benefits of Purchasing Silver Bullion

1. Hedge Against Inflation

One of the primary reasons investors decide to purchase silver bullion is to protect their wealth from inflation. As the cost of living rises, the value of currency often declines. Silver provides a tangible asset that can hold its value over time, especially when fiat currencies weaken.

2. Portfolio Diversification

Every savvy investor knows that diversification is key to managing risk. Silver bullion is a physical asset that can provide balance against volatile stock markets. Including silver in your investment portfolio can enhance stability and risk-adjusted returns.

3. Potential for High Returns

Historically, silver has the potential to yield significant returns, especially during times of economic uncertainty. Investors who purchase silver bullion may benefit from price increases due to shifts in market conditions, speculative trading, or industrial demand surges.

4. Accessibility and Liquidity

Silver is one of the most accessible precious metals for individual investors. You can buy silver bullion in various forms, such as coins and bars, from numerous dealers, including DonsBullion.com. Moreover, silver bullion is highly liquid, meaning you can easily sell it whenever you need, making it a practical choice for immediate financial needs.

How to Purchase Silver Bullion Safely

1. Choose a Reputable Dealer

When deciding to purchase silver bullion, choosing a reputable dealer should be your first step. Look for established businesses with positive reviews and feedback from customers. Verify their accreditation with relevant organizations to ensure you're dealing with a trustworthy provider.

2. Understand Pricing Structures

Silver prices fluctuate based on market demand and other economic indicators. Make sure you understand the pricing structures, including premiums above spot prices, which can vary significantly among dealers.

3. Know Your Options

Silver bullion comes in several forms:

- Coins: Governed by government mints and typically include pieces like the American Silver Eagle and Canadian Silver Maple Leaf.

- Bars: Available in various weights and usually produced by private mints. Bars often offer lower premiums than coins.

- Rounds: Similar to coins but not currency, rounds offer a less expensive way to own silver.

4. Storage Solutions

As a physical asset, silver bullion requires secure storage. Consider the following options:

- Home Safes: Investing in a high-quality safe can provide security at home.

- Bank Safe Deposit Boxes: These offer extra security but come with a rental cost.

- Professional Vaults: Engaging a professional storage provider can offer high-security solutions with insurance coverage.

Silver Bullion as a Long-Term Investment

Investing in silver bullion is generally viewed as a long-term strategy. Prices can be volatile in the short term as they react to various economic indicators, geopolitical events, and market trends. Understanding these factors can help you time your purchases and maximize your investment returns effectively.

1. Market Trends

To make informed decisions, stay updated on key market trends that influence silver prices, including:

- Global Economic Conditions: Economic slowdowns can increase demand for silver as a haven asset.

- Industrial Demand: Keep an eye on advancements in technology that utilize silver.

- Currency Strength: Weakness in the dollar can lead to increased investment in silver as a hedge.

2. Investment Strategies

As you consider your goal for investing in silver, think about the following strategies:

- Dollar-Cost Averaging: Consistently buying silver over time can reduce the impact of volatility.

- Buy During Dips: Take advantage of market downturns to purchase silver at lower prices.

- Rebalancing Your Portfolio: Regularly assess your portfolio to ensure that your investment in silver aligns with your overall financial goals.

Conclusion: The Smart Choice for Investors

In summary, choosing to purchase silver bullion can be a strategic move in your investment journey. With its historical significance, industrial value, and potential for both liquidity and long-term appreciation, silver stands out as a precious metal worth considering.

For more information on silver bullion and to browse quality options, visit DonsBullion.com today. Whether you’re a seasoned investor or just starting, silver bullion can be a rewarding addition to any portfolio.